China’s monopoly and the G7 Response

Certain minerals as crucial to many key industries in technologically advanced nations. China has been buying up important sources of those minerals and using these assets for political purposes 😳

Carolina Avendano wrote “G7 Critical Minerals Deal Will Seek to Address China’s Non-Market Practices, Energy Minister Says” for the EPOCH TIMES, posted online today.

Key Takeaways

China had become the world’s leading refiner by 2023 of key minerals such as copper, cobalt, lithium, natural graphite, and rare earth elements—refining more than 90 percent of global rare earth materials and producing about 69 percent of the world’s rare earth output.

Beijing introduced tighter export controls on rare earth minerals earlier this month amid ongoing trade tensions with the United States. President Donald Trump criticized the move, calling it “hostile” and accusing China of using rare earths as a form of leverage in trade disputes.

“There is no way that China should be allowed to hold the World ‘captive,’ but that seems to have been their plan for quite some time, starting with the ‘Magnets’ and other Elements that they have quietly amassed into somewhat of a Monopoly position, a rather sinister and hostile move, to say the least.” ( - Donald Trump)

G7 countries are set to announce a critical minerals pact this week aimed at countering China’s market-distorting practices, Energy and Natural Resources Minister Tim Hodgson says.

Hodgson and Environment Minister Julie Dabrusin are hosting a two-day G7 meeting of energy and environment ministers in Toronto this week. Hodgson said a critical minerals pact, set to be unveiled on the second day of the meeting, Oct. 31, will aim to strengthen supply chains and reduce reliance on China.

Sustainable geopolitical economic warfare

QUESTION: Why can nations continue to fight costly battles on the economic chessboard of the global economy?

ANSWER: An endless supply of free money from the “money pointing machines” of every nation with a central bank that can bankroll their governments with a bottomless pit of “fiat money”.

Why is this important❓

It is a historical fact that America could not have afforded its entry into WWI if its currency had still been backed by gold.

Perplexity explains:

https://www.perplexity.ai/search/2ec6154d-e46a-4c70-85d2-0106c5c43936#0

The Federal Reserve was first established on December 23, 1913, when President Woodrow Wilson signed the Federal Reserve Act into law. This act created the Federal Reserve System as the central banking system of the United States, responding to financial panics and aiming to enhance the stability and functioning of the American banking system. The 12 regional Reserve Banks officially began operations on November 16, 1914.

The Fed’s role in enabling U.S. entry into World War I and sustaining fiscal support through the war hinged on financing, liquidity, and market operations that aligned with wartime needs.

Core roles

- Financing the war effort: The Federal Reserve facilitated the Treasury’s bond drives (notably Liberty Loans) by marketing and distributing war bonds and by lending to member banks at favourable terms that supported bond purchases. This reduced the government’s borrowing costs and broadened the investor base, helping to mobilize large-scale funding for military expenditures [source material reflects Fed acting as fiscal agent and lender to banks in support of bond sales].

- Providing liquidity to the banking system: By offering discount window access and other facilities on favourable terms, the Fed ensured banks remained liquid during wartime surges in government borrowing and private credit needs. This maintained smooth credit flows to both the government and private sector as war demands intensified.

- Stabilizing short-term credit conditions: Through its monetary policy actions and the management of interest rates for member banks, the Fed helped temper credit stress and supported stable financing conditions as Treasury debt issuance expanded dramatically (thousands of millions in war funding) and inflationary pressures began to emerge.

- Supporting the Treasury’s fiscal operations: The Fed’s collaboration with the Treasury included serving as a conduit for war finance, aligning monetary policy with the government’s need to mobilize resources efficiently while maintaining the integrity of the financial system.

Context and trade-offs

- Independence versus wartime needs: Although the Fed was designed to operate independently to insulate monetary policy from political pressure, the crucible of World War I led to a greater alignment between Federal Reserve actions and Treasury financing needs. This arrangement helped sustain debt finance at favourable rates, but it also meant that monetary policy prioritized financing objectives during the war period.

- Inflation and coordination: The expansion of credit and government borrowing contributed to inflationary pressures, and the postwar period would require policy adjustments to restore price stability—the wartime experience shaped later insights into coordinating fiscal-miscal management with monetary policy.

Notice the jargon.

Terms like “liquidity” and “credit” seem benign enough and lead average citizens to believe that “public debt” is not a problem or that “inflation” is a small price to pay to defend “democracy”.

After these terms are correctly understood and the long-term consequences are assessed over time, I wonder how many citizens today would agree with the slippery slope that began on December 23, 1913, when President Woodrow Wilson signed the Federal Reserve Act into law.

What were some of the costs?

How many fighting men and women have died or been disabled because “free money” was supplied by central banking systems like the Fed and the Bank of Canada to supply federal Treasury departments with the “liquidity” to finance their war machines?

How many people and businesses died during “The Great Depression,” which was the consequence of runaway federal spending financed by “public debt” to unsustainable levels?

How much “fiat money” has been spent to create the justification for the excessive growth, cost and scope of power & authority imposed on citizens and businesses, to the never-ending burden that these impose on generation after generation?

China also carries dangerously high public debt levels, and Japan’s is the highest in the world on a per capita GDP basis. Would China have been able to buy all the rare earth mineral properties if its currency, and all of the world’s currencies, were still backed by gold?

The bottom line❓

Neither China nor America, with its G7 allies, could afford to play this high-stakes game of economic chess without a central banking, fiat currency system to finance it😲

The #1 Problem today.

I’ve repeatedly said that “too much government is our #1 problem today”.

However, please understand that it has been enabled for many decades by the “fiat money” systems that operate in every nation that runs a US Fed-style central banking system.

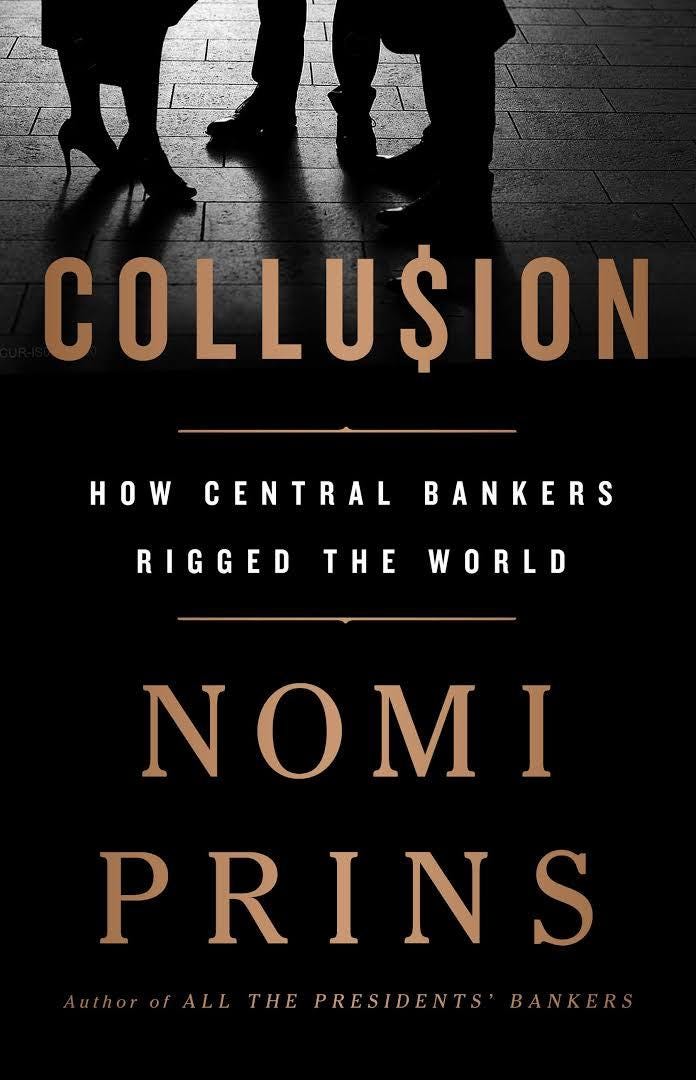

In her excellent book “Collu$ion, How Central Bankers Rigged the World”, former Wall Street insider Nomi Prins shows how the 2007-2008 financial crisis turbo-boosted the influence of central bankers and triggered a massive shift in the world order.

This important book tells the story of the most powerful and influential banking elites within the world’s seven largest nations, who pulled their levers of power to bail out the most significant financial stakeholders during the 2008-9 “Great Recession”.

Then they passed “the bill” onto each nation’s citizens 🤯 ❗️

I have just started reading THE CREATURE FROM JEKYLL ISLAND.

Great summary. I will not sleep tonight, LOL. It seems our entire monetary system is TURTLES ALL THE WAY DOWN. What can the average citizen do to save the proceeds of their work?