The chase is on.

Advances in technology have always had early adopters. Meanwhile the majority of people go about their daily lives oblivious to tech-inspired changes going on around them. Enter Finance Phantom.

Up in smoke

Digital money is here to stay and paper money will be a thing of the past within the next generation.

Professions like wealth management advisors, lawyers and many in the public health arenas will all experience serious disruption.

This article caught my attention.

It’s curious to me why the owner of a house in Toronto’s exclusive Bridle Path would house $1.2 million in $100 bills. It was also a very strange public phenomenon that those bills would burn up in a house fire.

House fires can’t burn digital money.

Digital currency and AI are both here to stay, and this combination will continue to drive new ways to store and distribute wealth as it has done for users of Finance Phantom. Those $100 bills would not have gone up in smoke if they were stored and managed safely and profitably in digital form as a typical Bitcoin hodler might have advised.

What is wealth?

Wealth is created when goods and services are produced that people want and for which they are willing to pay.

Finance Phantom is a new service into which people are voluntarily putting their money expecting a positive return on their original stake. As such, this service will generate revenues and profits for the owners of Finance Phantom which qualifies it as a wealth creator.

On the other hand, Finance Phantom is also a wealth distributor.

Finance Phantom provides its users a game-changing advantage over other stock market traders who will lose their investments to Finance Phantom users.

No new wealth is created in the stock market by this trading mechanism. Instead, it only serves to distribute existing wealth from trade losers to trade winners.

Not a Ponzi Scheme.

It’s not a Ponzi scheme as some people may suspect.

Instead, it is a technological advance that tilts the game of stock market investing in favour of Finance Phantom users.

What’s next?

My guess is that the financial authorities will try to shut Finance Phantom down because it has the potential to dominate stock market investing by giving an “unfair advantage” to its users.

Likely, the authorities will try to stop it using established anti-trust laws which have been created to stop private sector corporations from creating a monopoly within a business sector.

As we know, antitrust laws do not apply to government entities. They operate monopolies by design and with impunity.

If these government monopolies can find a way to benefit from it, Finance Phantom will surely be allowed to flourish.

Another scenario…

Competing platforms will emerge to provide potential users with options that may serve different user communities in unique ways to their advantage.

Over time, these new platforms will transform stock market investing into an AI-driven industry that will likely render the work of human stock brokers and wealth management advisors obsolete.

In this last scenario, regulators will attempt to “manage” (i.e. regulate) trading activities and outcomes in a way that satisfies primarily the goals of politicians, public officials and influential lobbyists. We have seen this approach play out many times in the past.

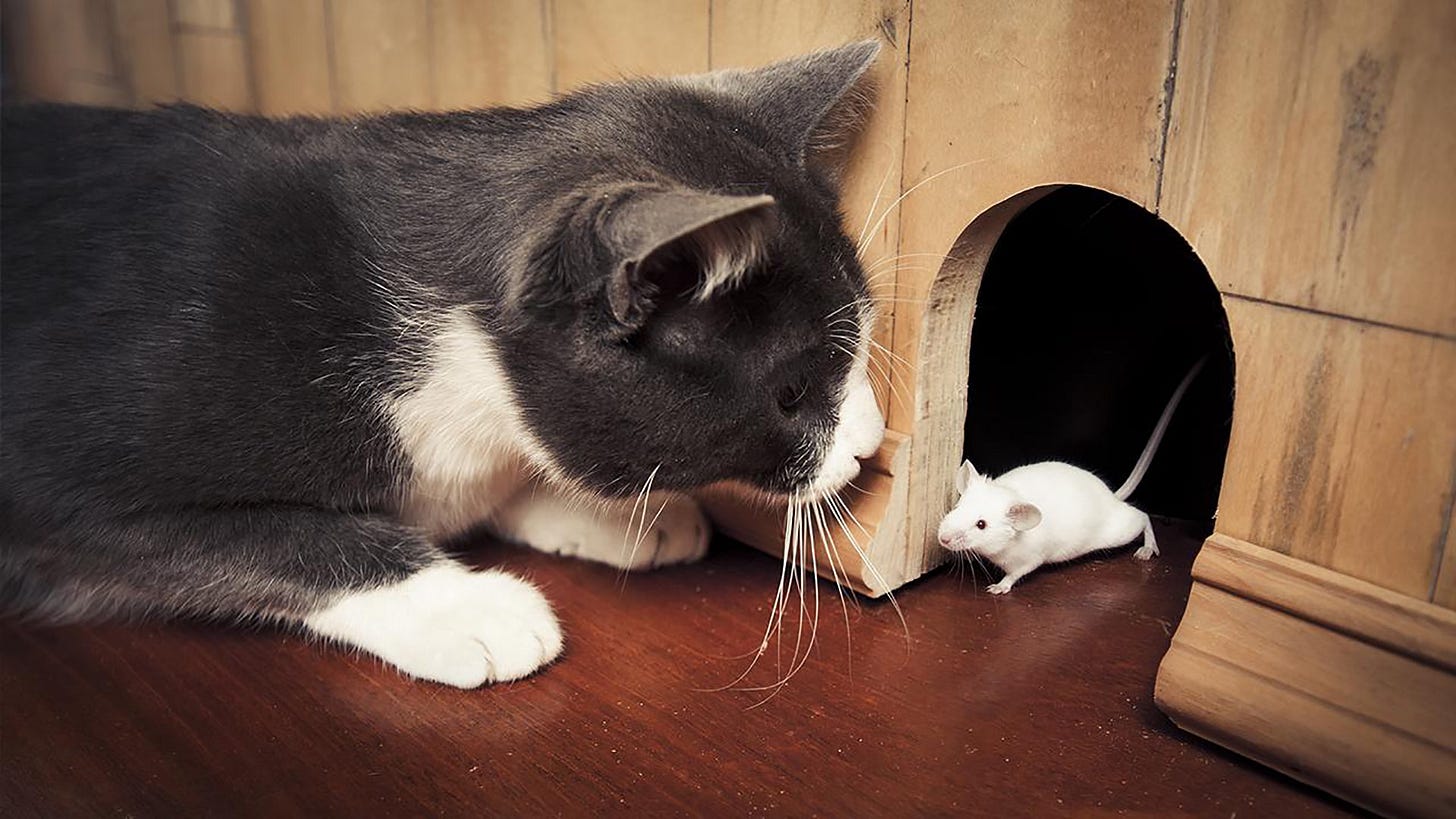

It will be interesting to watch the “cat and mouse” regulatory game ensue in which the mouse always seems to be a few steps ahead of the cat.

We already have digital currency… it’s called “credit cards”.

At any rate, they need all major currencies to be digital in order fir CBDC to work, meaning they need Trump to agree on this. Good luck with that. CBDC is like BRICS$… fear mongering to drive fools to hoard gold, Bitcoins… both of which are already highly digitally regulated. Have you tried to sell gold recently? Think about how to use assets to buy groceries before you leap.

Perhaps house fires can burn up paper money, but what is to stop DIGITAL money from evaporating into a CLOUD of one sort or another?